22 Aug Technology and disruption in the insurance sector

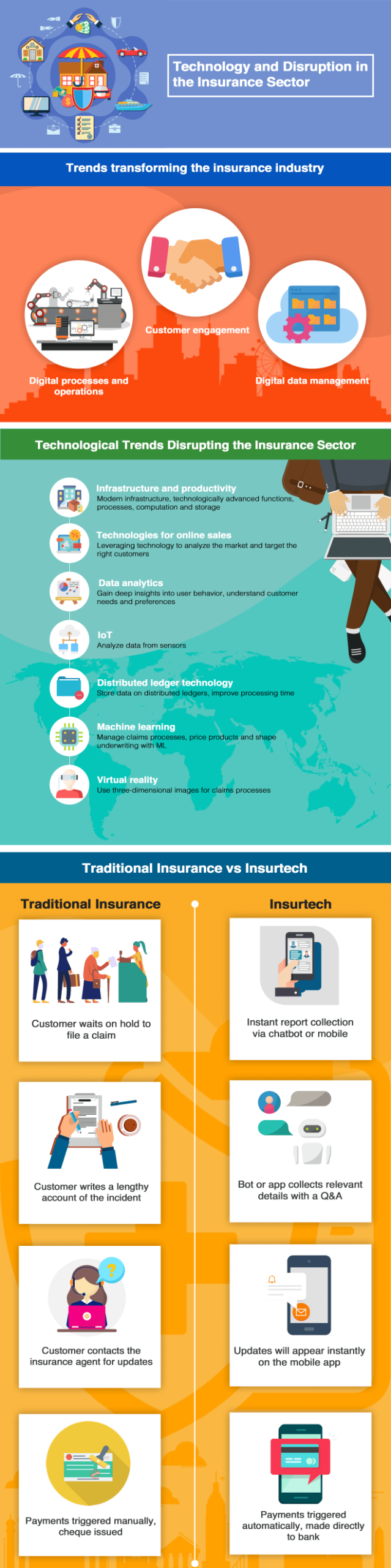

What are the technological trends disrupting the insurance sector?

A report by IBA suggests that there are broadly seven disruptive technology trends that are changing how business is done in the insurance sector.

- Infrastructure and productivity: Digital innovation needs modern infrastructure. This includes technologically advanced ways of not just functioning and processing, but also computation and storage.

- Technologies for online sales: Insurers are leveraging the most modern technology to target their right customers, pinpoint the ideal user andanalyzeconsumption.

- Data analytics: Analytics allows users to gain deep insights on userbehavior, that helps insurers gain insights into customer needs and preferences. IoT: Analyzing data from sensors can help insurers to understand user behavior.

- Distributed ledger technology: By storing data on distributed ledgers, insurers can greatly improve the time taken for processing.

- Machine learning: Insurers can use machine learning to manage claims processes, price products and shape underwriting.

- Virtual reality: Virtual realitycan usethree-dimensional imaging to ascertain how a particular incident happened by reconstructing the environment in which it happened – a room or building – to absolute precision.

Customer journey – traditional insurance vs insurtech

So, what does a customer journey look like with these technological advancements?

To start off, claims filing processes would become a lot easier. Compared with a customer waiting on hold over a phone call to report a claim, a mobile application would make reporting a lot easier and faster. Instead of having to pen down a long and painful notice of loss, an app would ensure quick and easy collection of details with simple Q&As, photo upload and sensors. There’d be superior convenience with regard to communication. Not only will updates be shared as and when they happen, but the customer will also be fully in the loop of claims redressal as compared to a traditional model of calling to follow up. Payments would be made directly to the bank account and triggered automatically on completion of formalities as compared to manual triggering and cheques.

How Insurers Avoid Being Blindsided by Insurtech Disruption

Emerging technologies are being smartly leveraged by businesses to drive themselves forward. However, insurers need to be farsighted and strategic about the technologies they adopt. While it is essential to stay in the competition and keep an eye out to see what competitors are doing, businesses need to carefully analyze their strategies to ensure they are not blindsided by the disruption in insurtech. To do this, insurtech businesses must adopt agile, long-term technology investments, personalization and customization of services, based on a strong and agile technology foundation.

Regulations and insurtech

With the exponential growth of computing power, the insurance domain has been opened up to sophisticated forms of data collection and analysis, including data mining, statistical modeling, and machine learning. These evolving techniques have made it increasingly challenging for insurance regulators to evaluate rating plans that incorporate complex predictive models. To address this issue, insurance regulators are considering various methods of field testing such technologies in a controlled environment. Several US states have indicated they believe their insurance laws contain sufficient flexibility to permit the issuance of regulatory variances and waivers (e.g., no-action letters) to InsurTech firms seeking to test new products without fear of regulatory action, and have encouraged firms to talk to them.

The Future of Insurtech

This said, the future of innovation in insurtech is intertwined with regulations. Any new or innovative change in the insurtech sector would require regulatory approval, therefore insurers and regulators must work together to determine a way of working. Obtaining regulatory buy-in at an early stage is often critical for ensuring a relatively fast and painless regulatory approval process. This can also significantly improve a company’s speed to market. However, regulators should be ready and willing to have a dialogue with the industry on the future of insurance regulation, and companies looking to disrupt the insurance industry should consider taking them up on their offer.